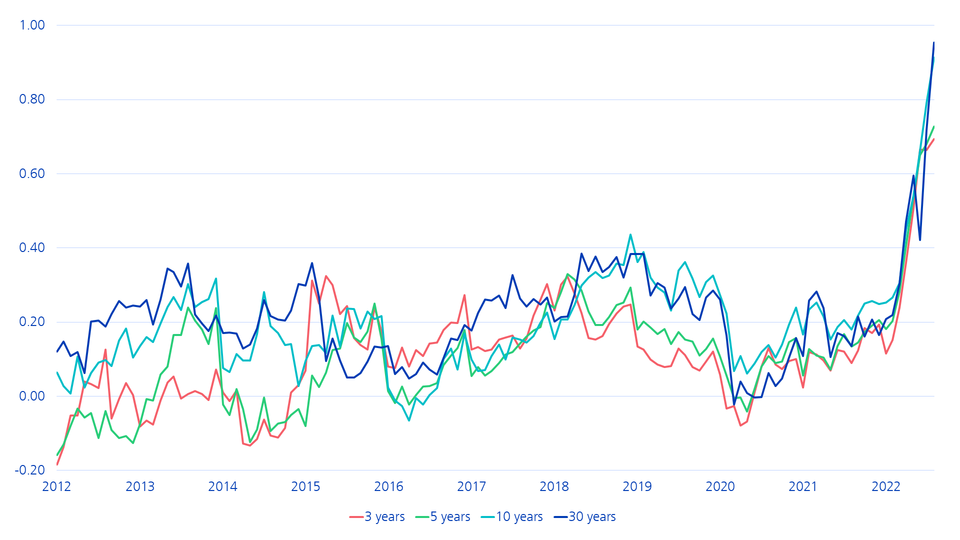

Historically, the 10-year swap spread in Switzerland is mostly between 0 and 40 basis points. However, it currently amounts to around 90 basis points, as shown in the following chart. The difference over the past ten years has never been so great.

Confederation bonds are too expensive

The interest rate difference between the swap rate and Swiss government bonds, or Confederation bonds, is extraordinarily large. We identify some attractive alternatives.

The main driver for the divergence of yields on swaps and Swiss government bonds, or Confederation bonds, is probably mainly due to demand and supply dynamics. The energy crisis, inflation, war and the tightening of the Swiss National Bank’s monetary policy bring with them many uncertainties. The long-term environment of low or even negative interest rates made fixed-interest investments unattractive. Now the tide has turned. In view of the impending interest rate hikes, everyone wants to be on the same side of the trade in the swap transaction: receiving rising variable SARON rates and paying the fixed interest rate. The high uncertainty and positive interest rates are increasing demand for safe Confederation bonds. This is why the swap spread is currently at a very high level.

Should the energy crisis intensify and Russia completely shut down its gas supplies, there is a risk of a sharp recession. Accordingly, the swap spread would probably remain high and would not return to the long-term average until the situation has calmed down.

How can this benefit you?

We actively manage the swap spread in our investment products and are convinced that this creates added value for our customers. In this context, Confederation bonds have been judged too expensive for months and we have therefore successively reduced the weighting of Swiss government bonds in our investment products.

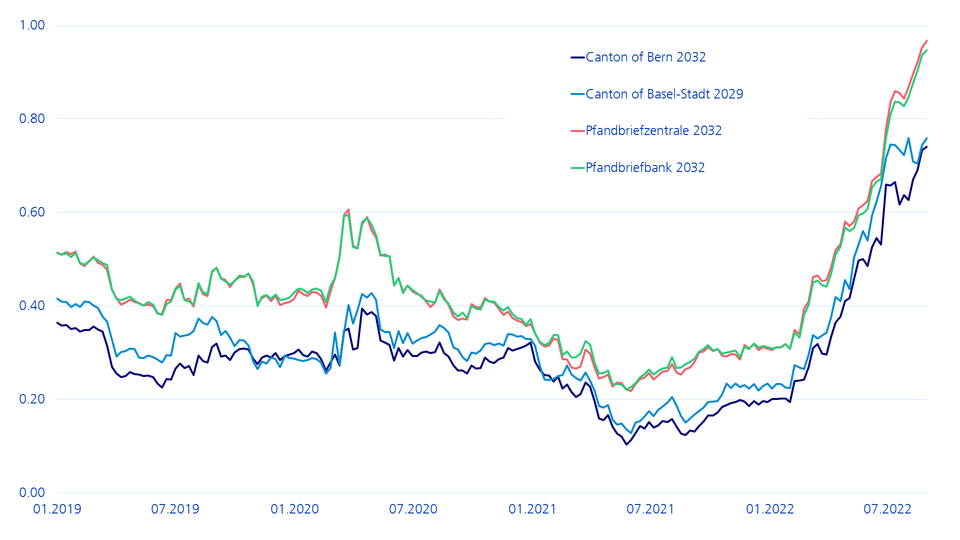

We compensated for the underweight in Confederation bonds with other bonds in the AAA and AA segments. Examples include cantons, Swiss cities, the Swiss Pfandbriefzentrale or the Pfandbriefbank of Swiss mortgage institutions. Bonds from these issuers currently trade at an attractive premium compared to Confederation bonds and are regarded as very safe with their high credit rating. The chart below shows the increased spreads relative to Confederation bonds.

Attractive premiums relative to Confederation bonds

The function of the swap spread

Swaps reflect the interest rate expectations of the market and represent an attractive instrument for many market participants to manage their interest rate risk in a cost-effective manner. The swap spread refers to the mark-up of the swap rate on the yield of a risk-free government bond with the same maturity.

The starting point for the Swiss franc interest rate curve is the SARON (Swiss Average Rate Overnight). The Swiss 5-year swap spread, for example, therefore corresponds to the difference between the 5-year swap rate and the yield on a 5-year Swiss Confederation bond. The swap curve is derived from the various swap interest rates of all available maturities.

What influences the swap spread and what does it mean?

The swap curve is usually similar in shape to the corresponding government bond's yield curve. In the past, the spread across maturities was mostly positive. This is because banks generally have a higher credit risk than government bonds. Factors such as liquidity or supply and demand dynamics also play an important role.

The level of swap spreads is an indicator of the prevailing risk sentiment in the market. In other words,

- if the demand for hedging the interest rate risk increases, market participants are prepared to pay more for hedging. "Swapping" the risk becomes more expensive and results in higher swap spreads.

- if demand for government bonds rises sharply, this will lead to a higher swap spread due to the declining yield. Confederation bonds are seen as a "safe haven" in times of increased uncertainty and high risk aversion.

- In the past, a rise in the swap spread could also be observed when the markets priced in interest rate hikes by the central banks.